Keen to Invest in South-east Asia? Invest Islands Study Compares Five Top Locations

Contact

Keen to Invest in South-east Asia? Invest Islands Study Compares Five Top Locations

Indonesian real estate brokerage Invest Islands recently completed a market study of five of the region’s top investment destinations, looking at land prices, ownership regulations, and various factors related to growth.

While Southeast Asia has always been a fundamental part of global business, the likes of Indonesia, the Philippines, Thailand, and Vietnam are now investment destinations in their own right.

With that in mind, Indonesian brokerage Invest Islands completed a market study of five of the region’s top investment destinations, looking at land prices, ownership regulations, and various factors related to growth.

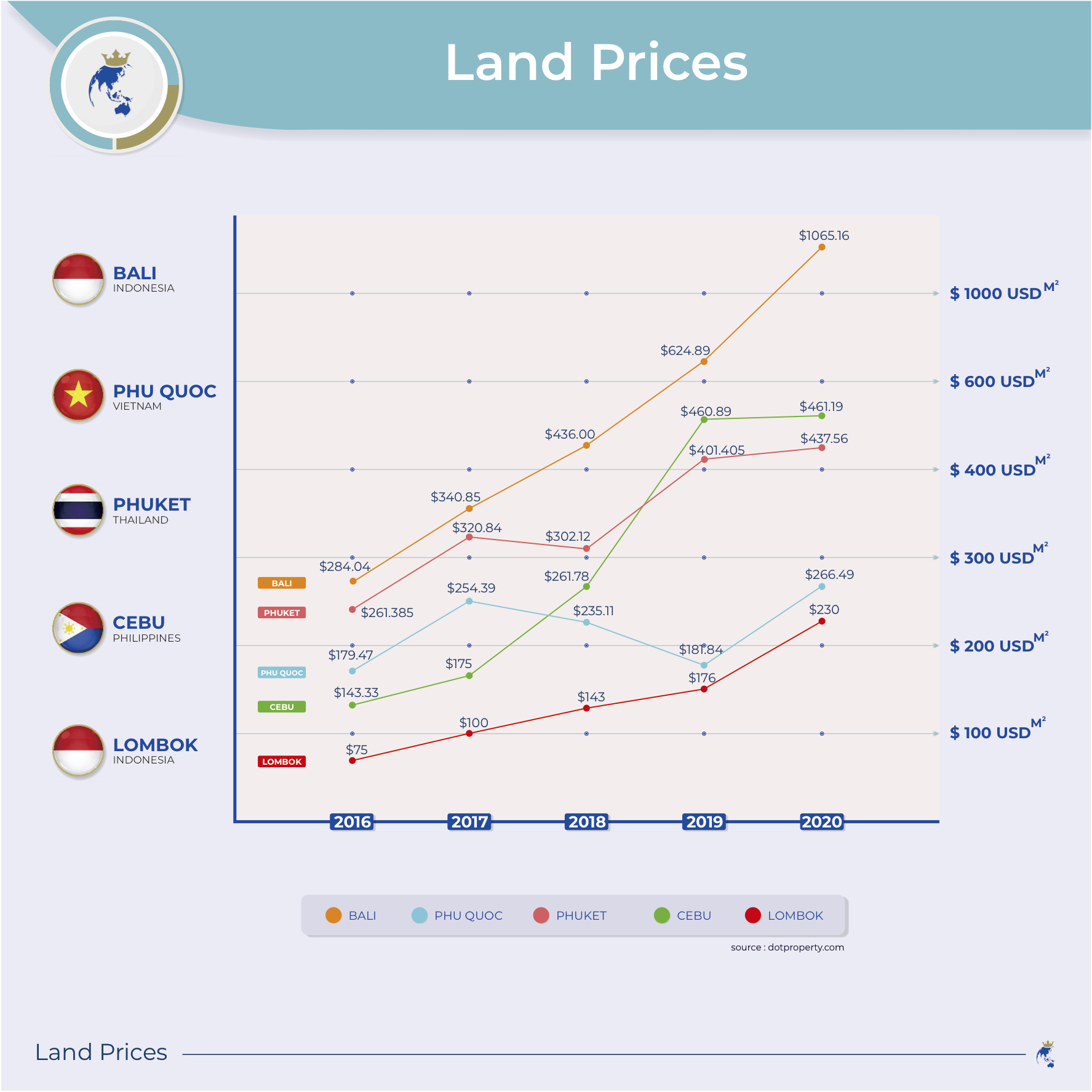

According to the report, Bali land prices have jumped 71 per cent across the past 12 months to sit at $1,065 per square metre, with the level of investment required to enter the market "clearly very high".

Source: Invest Island

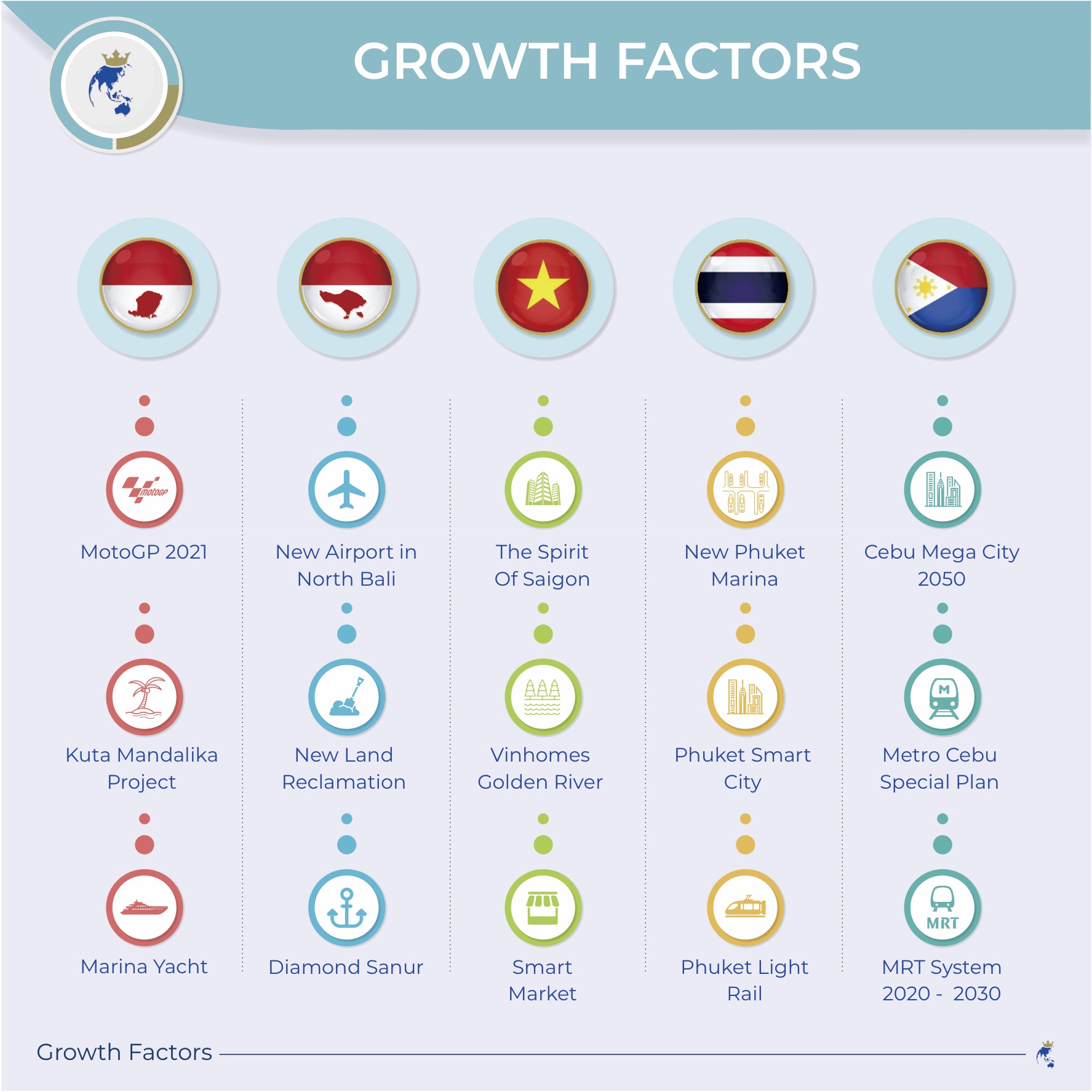

Thirty minutes east on Lombok, the Indonesian Government is hoping to create a similar situation, identifying the island as a key component of its “10 New Balis” initiative.

The data shows land prices on Lombok have increased more than 200 per cent in four years, yet still list for as little as US$230 per square metre.

Invest Islands co-founder Jack Brown said massive federal investment, such as the $3 billion Mandalika Project on the island’s south coast, would lead to a steep climb in land prices on Lombok in the years ahead.

“Mandalika is going to transform the southern coast of Lombok,” he said.

Source: Invest Islands

“From 2021, its custom-built racetrack will host a round of MotoGP for at least the next decade, while a host of major hotel chains have already broken ground and our own beachfront resort will open its doors in 2022.

"The government has made it very clear it is committed to making Lombok one of Southeast Asia’s most popular tourist hotspots, but just now it’s still very much like Bali before the boom.”

Elsewhere, the Filipino island of Cebu has long been a popular investment location courtesy of its picturesque beaches, friendly atmosphere, and steadily increasing flow of families and backpackers.

According to Invest Islands, property values have historically risen, with certain areas such as the city’s business district almost doubling in price between 2010 and 2019.

Source: Invest Islands

Aside from strong economic growth, the report also indicates Cebu boasts a stable local economy, a skilled labour force, and enhanced international connections following the opening of Terminal 2 at Mactan-Cebu International Airport in 2018.

The market study identifies Phuket as another fast-growing Southeast Asian city where enticing investment opportunities can be found.

Already extensively developed, the modern Thai metropolis is filled with gyms and cafes, hip bars and restaurants, high-end shopping, and beautiful beaches.

The report lists the current cost of prime beachfront locations in Phuket at around US$1,000-$1,500 per square metre.

While there is currently ample housing units, Invest Islands Mr Brown believes increasing tourism and lowered interest rates could soon skew the supply and demand dynamic and increase the price of real estate.

“Much like both Bali and Lombok, Phuket is an island so available land is finite," he said.

“As development has increased over the years, the price of land has obviously increased with it.

"There is still definite value to be had, yet the entry-level investment required now means the Phuket ship has probably sailed for a lot of prospective investors.”

Source: Invest Islands

The data within the study presents the Vietnamese city of Phu Quoc as an accessibly-priced alternative

Located at the southern tip of the country, it welcomed around two million visitors in 2017, an increase of more than 70 per cent on the previous year.

With plans to upgrade the island’s infrastructure and high-end leisure facilities, a continued rise in tourism is very possible, according to the report, which adds the most expensive parcel of land in Phu Quoc costs less than US$270 per square metre.

The views and opinions expressed in this article are of Invest Islands and readers should rely on their independent advice in relation to such matters.

Click here to download a copy of the report.

THIS IS A SPONSORED FEATURE ARTICLE

Similar to this:

The Indonesian island paradise frequented by celebrities where land is still affordable

Invest Islands Foundation helping Lombok through pandemic disruption